🪙 Tokenization of Real-World Assets (RWAs): The Future of Blockchain Investment in 2025

Focus Keyphrase: Tokenization of Real-World Assets

🌍 Introduction

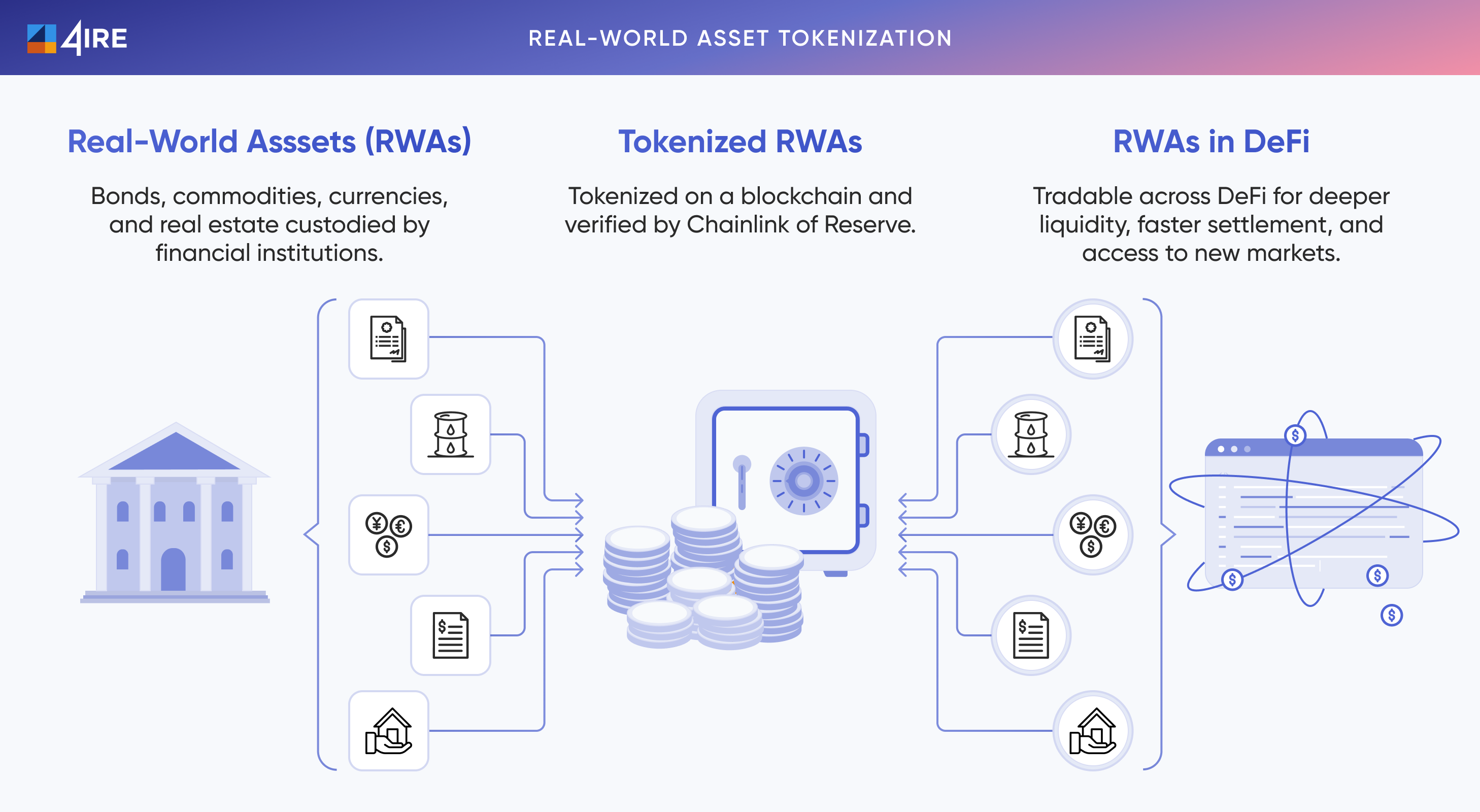

The tokenization of real-world assets (RWAs) is rapidly becoming a key driver of blockchain growth in 2025. It allows businesses to convert physical assets—such as real estate, gold, or art—into digital tokens on a blockchain. As a result, investors can buy smaller portions of valuable items, trade them globally, and enjoy faster, safer transactions.

In short, tokenization bridges the gap between the physical economy and the digital world, creating a smoother and more open investment landscape.

🧩 What Is Tokenization of Real-World Assets?

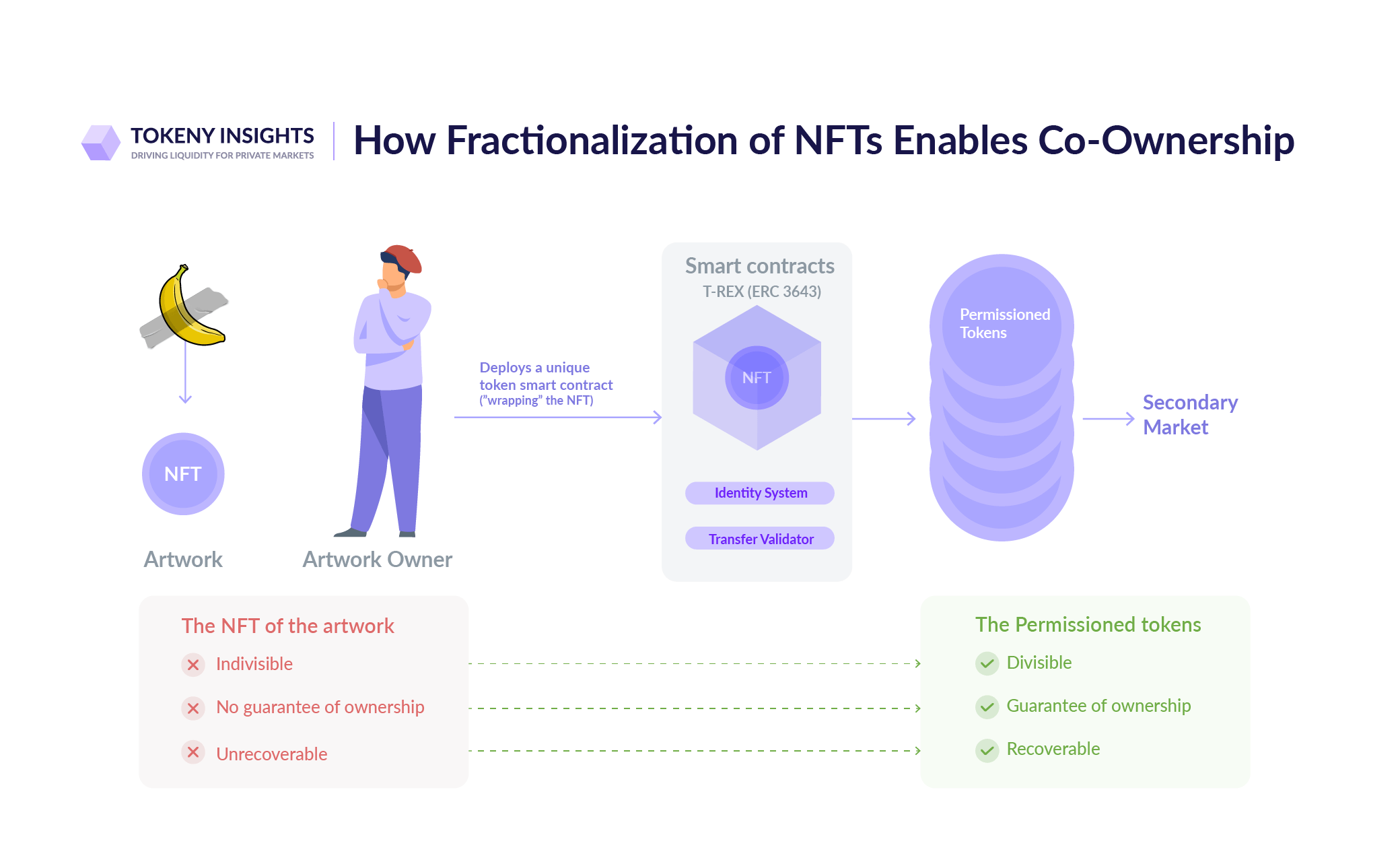

The tokenization of real-world assets means turning ownership rights of physical assets into blockchain-based tokens. Each token represents a portion of the asset, so investors can share ownership without owning the entire item.

For example, imagine a ₹10-crore commercial property divided into 10 lakh tokens, each worth ₹1,000. Now, anyone can invest in premium real estate without needing huge capital. Clearly, tokenization makes investment more inclusive and accessible.

🏦 Common Types of Tokenized Assets

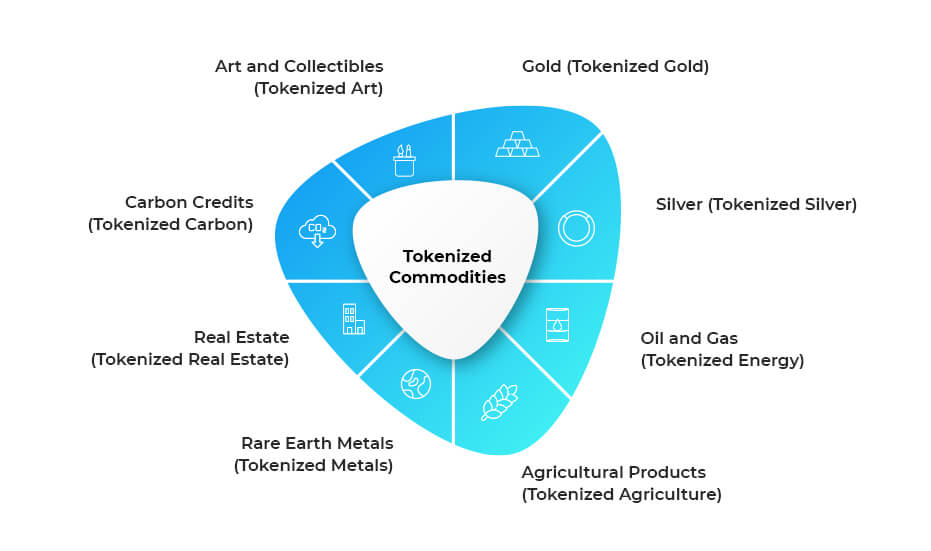

- Real Estate: Both residential and commercial properties.

- Art and Collectibles: Paintings, luxury goods, and NFTs.

- Commodities: Gold, oil, and other tradable resources.

- Debt and Bonds: Tokenized bonds allow faster settlements.

- Private Equity: Startups can raise funds through tokenized shares.

To explore further, read NASSCOM’s blockchain insights .

⚙️ How Tokenization Works

- Asset Verification: The physical asset is verified and legally registered.

- Smart Contract Setup: Smart contracts define ownership and transfer rules.

- Token Creation: Tokens are generated and distributed to investors.

- Trading: Holders can trade tokens freely on blockchain exchanges.

- Earnings Distribution: Rent, dividends, or profits are automatically paid to holders.

For additional details, visit Gate.io’s Blockchain Trends 2025 .

🚀 Benefits of Tokenization

| Traditional System | Tokenized System |

|---|---|

| Limited liquidity | 24/7 trading available |

| High entry barrier | Small, affordable investments |

| Manual paperwork | Automated smart contracts |

| Local access only | Global investor reach |

Clearly, tokenization improves liquidity, speeds up transactions, and builds trust among investors. Moreover, it opens the door for people who were previously excluded from major investments.

🧱 Key Elements for Blockchain Product Development

- Regulatory Compliance: Include KYC and AML features for investor protection.

- Asset Onboarding: Automate verification and valuation workflows.

- Lifecycle Management: Track token creation and redemption easily.

- User Experience: Offer simple dashboards and fiat on-ramps.

- Security: Use audited smart contracts and multi-signature wallets.

Learn more about blockchain product building from Evercode Lab’s 2025 Blockchain Trends .

💰 Real-World Use Cases

- RealT & Lofty.ai: Real estate platforms offering fractional ownership.

- Tokenized Carbon Credits: Supporting transparent sustainability markets.

- Art Tokenization: Allowing collectors to co-own valuable artworks.

- DeFi Collateralization: Using tokenized assets as loan collateral.

These examples prove that tokenization is practical and already transforming industries.

⚖️ Challenges Ahead

- Regulatory Uncertainty: Governments are still refining tokenization laws.

- Asset Custody: Securing physical items remains essential.

- User Education: Many investors still need guidance.

- Interoperability: Tokens must work smoothly across multiple blockchains.

As laws and standards evolve, these challenges will gradually reduce, allowing broader adoption.

🔮 The Future of Tokenized Assets

By 2030, experts expect over $16 trillion in global assets to be tokenized. As blockchain merges with AI and IoT, finance will become faster, fairer, and more transparent.

Visit our Blockchain Insights page to explore how tokenization connects with DeFi and Web3 innovation.